39+ can you write off interest on mortgage

Web If your home was purchased before Dec. Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Mortgage Interest Deduction A 2022 Guide Credible

Web For tax years 2018 through 2025 you can only deduct the interest from the amount of your loan that was used to buy build or improve the home that its secured by.

. Get Instantly Matched With Your Ideal Mortgage Lender. It Doesnt Hurt To Check. Low Rates Give A Much Needed Mortgage Stimulus For Homeowners Looking To Refinance.

Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million. Web Your mortgage lender will send you a form called Form 1098 that details the amount of mortgage interest you paid over the year. Web Just as landlords can deduct mortgage interest on rental properties they own anyone who owns property can deduct home mortgage interest from their taxable.

Ad Stop Searching Start Saving On That Monthly Mortgage Payment. There are also special rules regarding when you can apply your deduction for prepaid interest points. Lock Your Rate Today.

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Ad 10 Best Home Loan Lenders Compared Reviewed. Web Can You Write Off Mortgage Interest.

Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. 16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. This means when you.

Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1 million. Comparisons Trusted by 55000000. You can deduct the interest on up to 750000 of mortgage debt or up to 375000 if youre married and filing separately.

Web Just remember that under the 2018 tax code new homeowners and home sellers can deduct the interest on up to only 750000 of mortgage debt though homeowners who. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

You see in the US mortgage interest is considered tax-deductible. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Web Mortgage Interest Deduction For Prepaid Interest Points.

Web The write-off is limited to interest on up to 750000 375000 for married-filing-separately taxpayers of mortgage debt incurred after Dec. Web Most homeowners can deduct all of their mortgage interest. At least in most circumstances you can.

Review the amount of interest. 16 2017 and later. Web If you meet these conditions then you can deduct all of the payments you actually made during the year to your mortgage servicer the State HFA or HUD on the home mortgage.

Loan Application Letter Templates 13 Free Word Documents Download

39 Receipt Formats

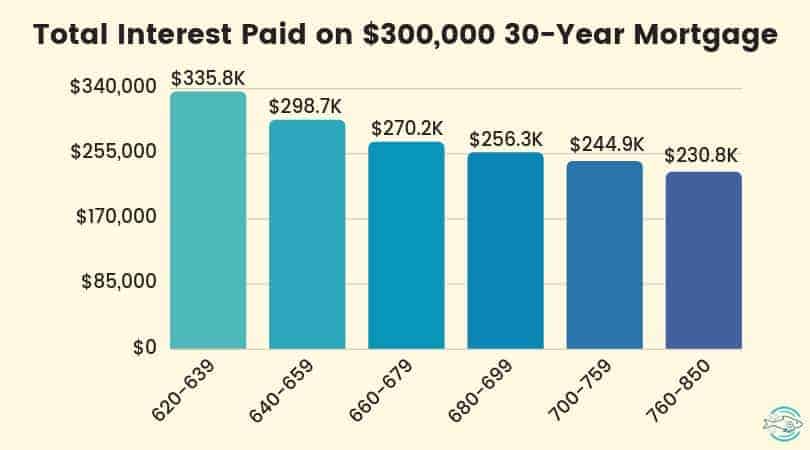

6 Valuable Benefits Of A Great Credit Score Smart Money Mamas

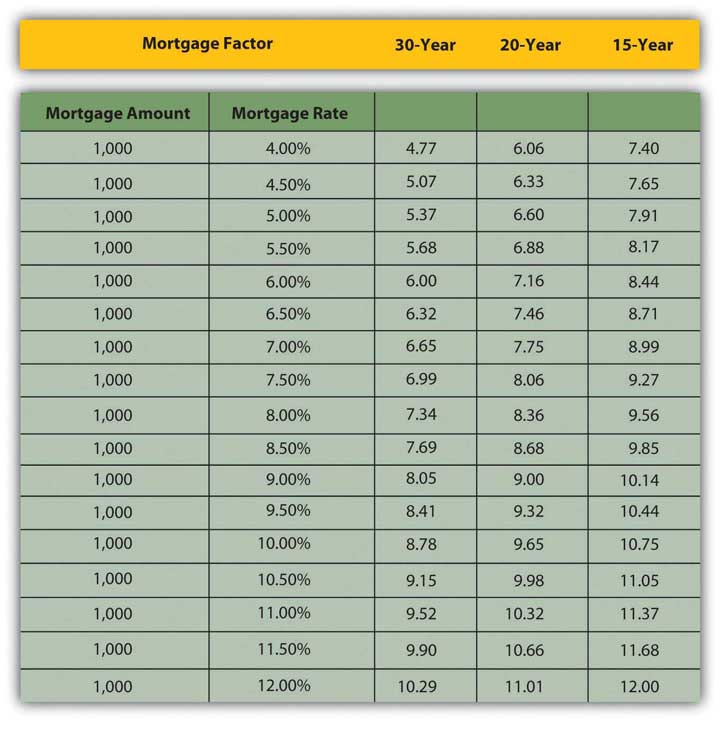

Solution You Can Afford A 1450 Per Month Mortgage Payment You 39 Ve Found A 30 Year Loan At 8 Interest A How Big Of A Loan Can You Afford B How Much Total

India Herald 070616 By India Herald Issuu

The Home Mortgage Interest Deduction Lendingtree

Bdcc Free Full Text Big Data And Its Applications In Smart Real Estate And The Disaster Management Life Cycle A Systematic Analysis

Goodbye 25 Year Mortgages But Are We Walking Into A Borrowing Trap Mortgages The Guardian

Mortgage Interest Deduction Bankrate

Mortgage Interest Rates Housing Finance Capital Markets Khan Academy Youtube

Mortgage Interest Deduction Bankrate

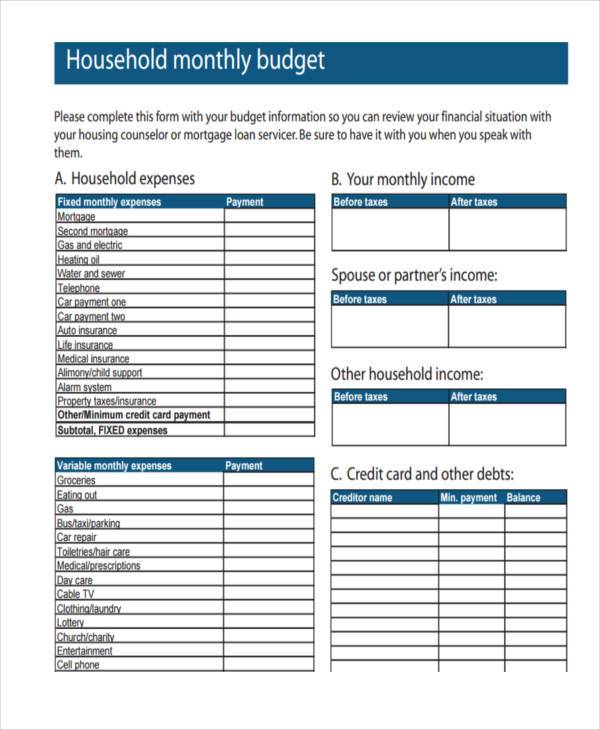

Free 39 Sample Budget Forms In Pdf Excel Ms Word

Identify The Financing

Bank Letter Templates 25 Sample Example Format Download

Mortgage Interest Deduction What You Need To Know Mortgage Professional

Mortgage Loan Wikipedia

Mortgage Interest Deduction Rules Limits For 2023