37+ How much you can borrow for home loan

The maximum amount you can borrow with an FHA-insured HECM in 2022 is 970800 up from 822375 the year before. Fill in the entry fields and click on the View Report button to see a.

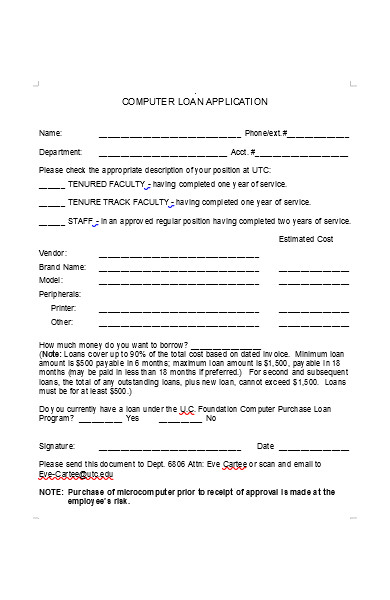

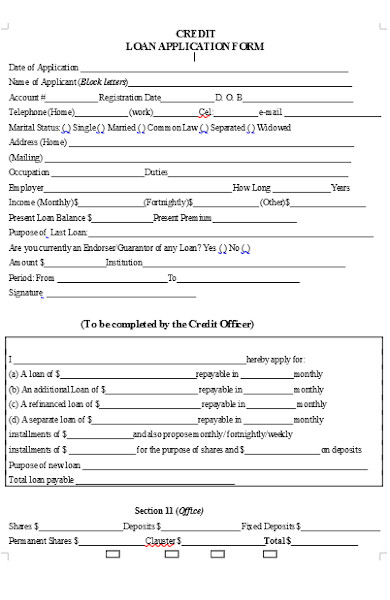

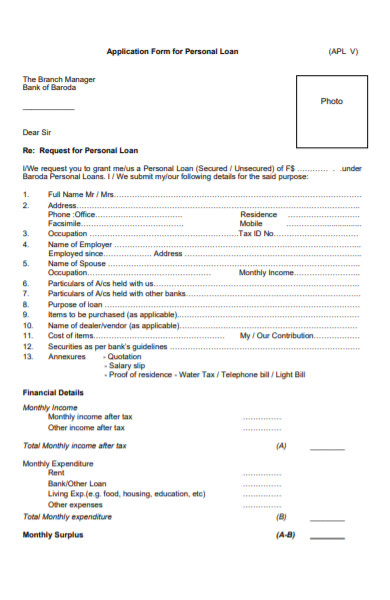

Free 55 Loan Forms In Pdf Ms Word Excel

You typically need a minimum deposit of 5 to get a mortgage.

. Ad Specialty Mortgage Brokers for Florida Texas California. Estimate how much you can borrow for your home loan using our borrowing power calculator. Work out 30 of that figure.

An initial interest rate set at 335 would go down to. You could borrow up to. Find out how much you can afford to borrow on a 75k 100k or 125k salary without suffering from mortgage stress.

Unlike other types of FHA loans the maximum. The first step in buying a house is determining your budget. If youre approved your lender may deposit the full amount you borrow in your.

But that still depends on your credit history and income. So if your lender is prepared to let you borrow 90 per cent of the cost of the property but you can afford. Any person who is of 60 years or more can avail the reverse mortgage scheme.

Find out more about the fees you may need to pay. How much do you have for your deposit. Most future homeowners can afford to mortgage a property even if it costs between 2 and 25 times the gross of their income.

The most a lender might offer you on a home equity loan in this case is 93500 or 85 of your 110000 home equity. This calculator is designed to illustrate how much you could borrow when approaching a mortgage lender to take out a mortgage based on your income. Heck even if you go directly to a bank or broker youll get different answers and the amounts can vary by as much as 200-300 especially if youre earning in a foreign currency.

Under this particular formula a person that is earning. The optimal amount for the best possible mortgage deal is 40 per cent. Take your annual income.

Monthly housing payment is determined not. Discount points lower your interest rate by 25 for each point paid. The maximum possible loan tenure is 35 years.

As mentioned earlier the maximum you can borrow on a conventional loan will be based on maximum debt to income ratio of 50. But if the loan tenure exceeds 30 years or would cause you to exceed the age limit of 65 see point 3 the LTV will decrease to 55 per cent. With just a few quick questions our online mortgage calculator will give you an idea of how much you could borrow show your mortgage rates and compare.

You must go through an approval process before you can borrow against your home equity. Divide by 12 to get a monthly repayment. So a very quick way to work out what you can afford to borrow is to.

The loan-to-value LTV limit determines the loan quantum ceiling you can borrow for housing loans. View your borrowing capacity and estimated home loan repayments Banking. Heres how those limits break down.

This is granted after considering the following factors. Variable Home Loan LVR 70 Product Features Min 30 deposit No monthly or ongoing fees add 010 for offset Unlimited redraws Monthly repayments1819 360 Advertised Rate. So a discount point for a home that costs 340000 is equal to 3400.

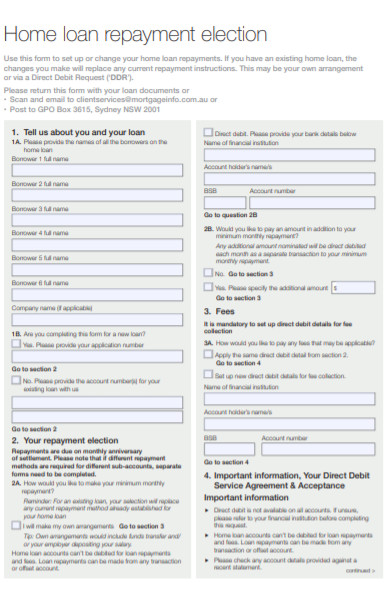

Banking Loans Home Loans Car Loans Personal. 1 day agoTo be able to avail this scheme the applicant needs to own the house. When you apply for a mortgage lenders calculate how much theyll lend based on both your income.

In case of a married. This calculator is intended to help determine your borrowing power by providing a snapshot of how much a lender is willing to loan you based on income expenditures and the home loan. This mortgage calculator will show how much you can afford.

All existing debts and.

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

This Moment Makes You Who You Are Clock Turning Point Truth This Moment Makes Y Spon Point Mortgage Loan Calculator Refinancing Mortgage Refinance Loans

Free 55 Loan Forms In Pdf Ms Word Excel

Personal Loan Requirements To Know Before Applying In 2022 Personal Loans Financial Management Debt Consolidation Loans

Get Home Loan In California Rcd Capital In 2022 Home Loans Refinance Loans Loan

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

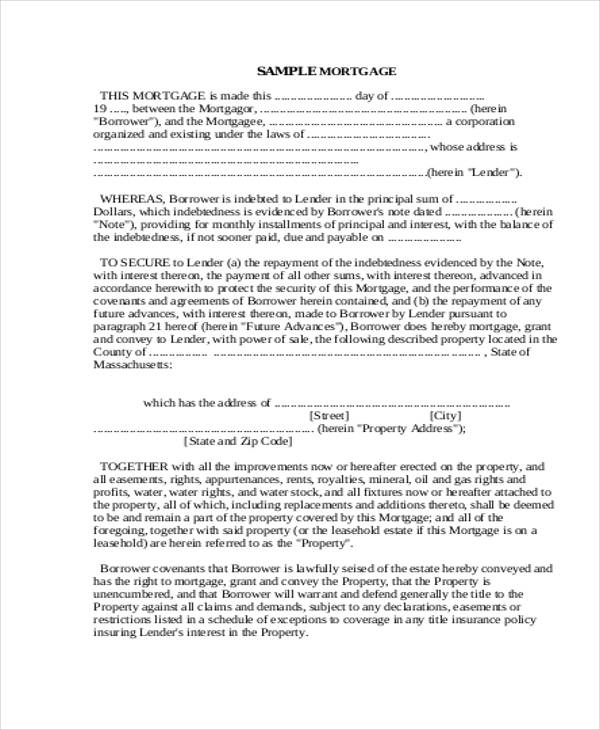

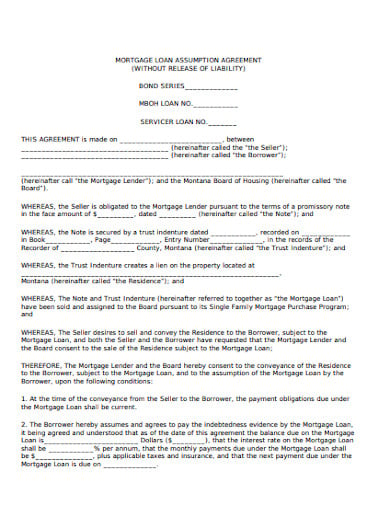

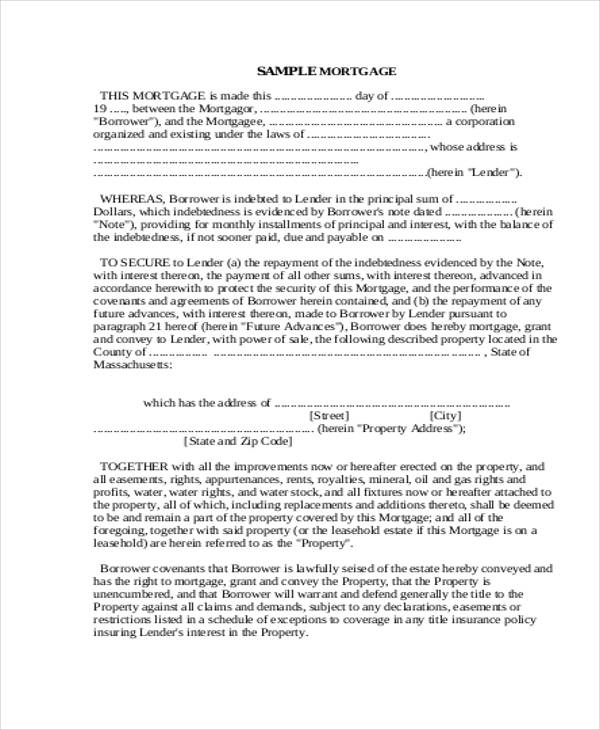

11 Mortgage Agreement Templates In Pdf Doc Free Premium Templates

Karvi Loans Lending Company Money Lending Loan

Free 55 Loan Forms In Pdf Ms Word Excel

Free 37 Loan Agreement Forms In Pdf Ms Word

Opting For A Home Loan From A Bank A Step Wise Guide By Nvt Quality Lifestyle Home Loans Loan Helpful

6 Tips To Get A Perfect Home Loan Deal Axis Bank

6a M66fatesxtm

Heloc Infographic Heloc Commerce Bank Mortgage Advice

Feeling That Homeowner Fomo Here Are Some Tips On How To Get Started With The Home Buying Process Home Buying Process Home Buying Home Financing

Free 55 Loan Forms In Pdf Ms Word Excel

Another Monday Another Mortgage Glossary Term Let Us Tell You A Little Bit About Appreciation Appreciati Home Equity Line Of Credit Mortgage Interest Rates